We aim to touch a billion lives with our best-in-class services.

Are you looking for a more cost-effective and flexible way to provide healthcare/medical benefits to your employees or members?

Self-funded plans may be the solution you're looking for. In a typical self-funded plan an employer takes on most or all of the costs of benefit claims. Such plans are more flexible to an employer and are not a subject matter of insurance. Self-funding offers the flexibility to meet healthcare challenges and allows better management of healthcare costs while still getting the benefit of a network - doctors, hospitals and specialists - with contracts that help determine prices.

At Medi Assist, we offer a range of self-funded solutions that help employers manage their healthcare costs while delivering high quality of health benefits.

Our differentiators

Competitive rates/contracts

Creative solutions that deliver value from their benefits investment and improve health.

Simplified program delivery

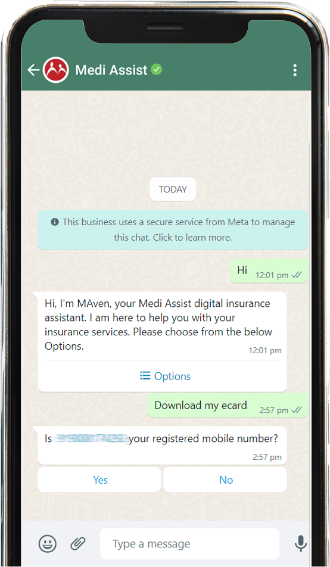

For a unified, engaging employee experience, we offer a range of digital platforms designed to improve the employee benefits experience.

Optimize benefits

We don't believe in a one-size-fits-all solution. Our approach delivers real-world solutions using Medi Assist-proprietary tools.

Prevention of fraud and abuse

We use features like electronic KYC, Two-factor authentication for claim registration to protect member data from fraudulent activities online.

Why choose Self-Funded Plans

No upfront funding

With Medi Assist's self-funded plans the employer or organization can pay for medical claims as they are incurred, potentially resulting in savings on interest and cash flow management.

No GST for claims costs

In self-funded plans, GST is only applicable to service fees and not to the actual cost of medical claims.

Only pay for Benefits Administrator costs

Unlike traditional insurance plans, where premiums may include various overhead costs, self-funded plans only require payment of the Benefits Administrator costs in addition to the actual medical claims costs.

Flexibility on benefit structure

Employers and organizations have complete flexibility in determining the benefit structure and administration of their self-funded plans. They can choose the coverage levels, limits, and other terms and conditions based on their unique needs and budget.

Benefit restructuring at any time

Another advantage of self-funded plans is that benefit restructuring can be done at any time, providing employers and organizations with the flexibility to adapt to changing healthcare needs and trends.

Transparency of data

Self-funded plans provide employers and organizations with detailed data on healthcare costs, utilization patterns, and other metrics that can be used to effectively manage healthcare costs and make informed decisions about benefit design and administration.

Always by your side, making every experience easy and smooth

General helpline: 0120 693 7372

Senior citizen helpline: 1800 419 9493